Reduce Your Price and Net Less

Reduce Your Price and Net Less

Sellers who must lower their asking price in order to close a deal will probably make less money overall.

PRICE REDUCTIONS

Carefully pricing a home allows sellers to walk away with the most money possible and achieve success quickly.

For professional track sprinters, getting out of the starting blocks quickly, fast, and first is often the difference in a race. There is plenty of preparation and training to be that runner that is the fastest off the blocks. The initial lunge is crucial and is an advantage that often propels the athlete with the best start across the finish line with arms raised high in the air.

Similarly, when a home initially comes on the market, pricing a home accurately is the difference between a seller raising their arms in celebration within the first few weeks versus taking months to sell and likely for much less. In today’s market, values are slowly declining. The longer a seller takes to properly price their home and secure a successful outcome, the more money they will ultimately lose.

One of the most crucial steps in being able to sell quickly, open escrow, and obtain the highest possible net proceeds from the sale of a home is to carefully arrive at its Fair Market Value. In every price range, homes sit without success, leaving these sellers wondering what in the world they are doing wrong. 37% of all homes in Orange County have been on the market for over two months, and 44% have reduced their asking price at least once. Throwing a price out there just to test the market is not a wise strategy. Instead, carefully, and methodically pricing a home is vital to cashing in on the Golden Opportunity, in the first few weeks after coming on the market. It would be better to spend several hours coming up with an extremely accurate price than to waste weeks or even months of precious market time.

Due to the high-interest rate environment, the market is lining up in favor of buyers during the negotiation process. Buyers do not want to overpay; they are unwilling to stretch. Accurate pricing is fundamental regardless of the temperature of housing, especially in a declining market. Throwing a price out there just to test the market is not a wise strategy. Ultimately, when asking prices of homes must be reduced in order to secure offers to purchase, it not only takes longer to sell, but sellers also sell for less. On average, the net proceeds check at the close of escrow is less if a price reduction is required.

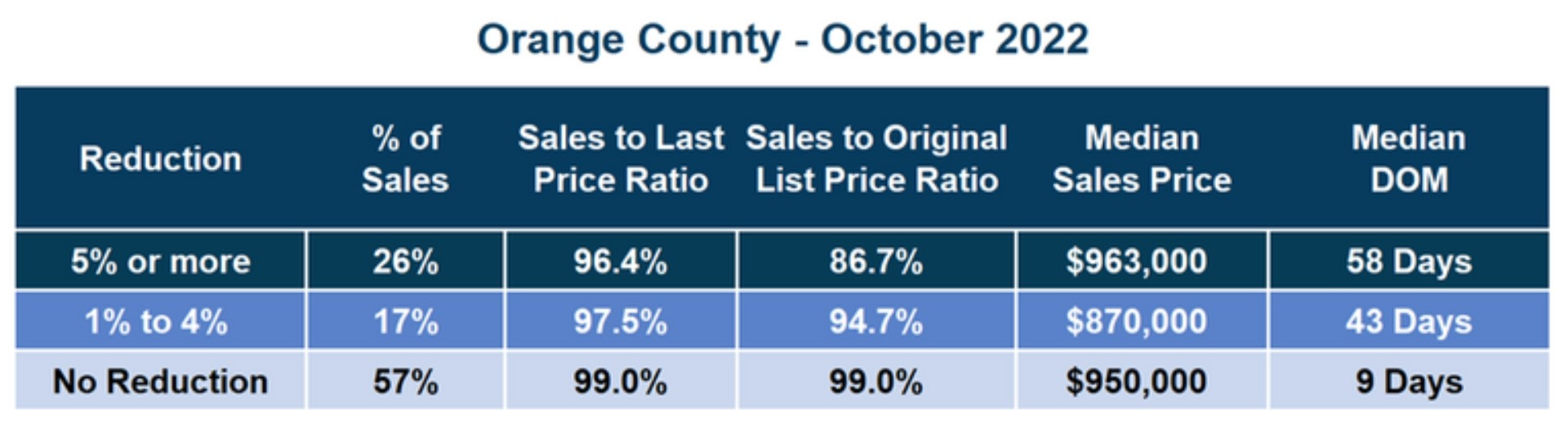

It is very telling to look at the sales price to last list price ratio. This refers to the final list price prior to opening escrow. These are averages, meaning there are exceptions, but the overall trend is stunning. In Orange County, 57% of all closed sales in October did not reduce the asking price at all. The sales price to last list price ratio for these homes was 99.0%, meaning, on average, a home sold within 1% of the asking price. A home listed at $1 million sold for $990,000, just $10,000 below the asking price. 15% of all closed sales reduced their asking prices between 1% and 4%. The sales-to-last list price ratio for these homes was 97.5%, and, on average, it took 43 days to open escrow. A home that reduced their list price to $1 million sold for $975,000, a considerable $15,000 less than homeowners with no reduction. For homes that reduced their asking prices by 5% or more, an astonishing 26% of closed sales in October, the sales-to-last list price ratio was 96.4%, after being on the market for a couple of months. A home that finally reduced their price to $1 million sold for $964,000. Everybody would agree that closing at $990,000 is a whole lot better than $964,000, a mind-blowing $26,000 better.

The data is staggering in looking at the sales price to the original list price. This is the price when a home initially comes on the market prior to any price reductions. For homes that reduced the asking price between 1% to 4%, the sales to original list price ratio was 94.7%. For example, a home that was listed originally for $1,056,000 had to reduce the asking price to $1 million to find success. Homes that reduced the asking price by at least 5% had a sales-to-original list price ratio of 86.7%. A home that was originally listed at $1,153,500 had to reduce the asking price, often more than once, to $1 million to find success.

The data is staggering in looking at the sales price to the original list price. This is the price when a home initially comes on the market prior to any price reductions. For homes that reduced the asking price between 1% to 4%, the sales to original list price ratio was 94.7%. For example, a home that was listed originally for $1,056,000 had to reduce the asking price to $1 million to find success. Homes that reduced the asking price by at least 5% had a sales-to-original list price ratio of 86.7%. A home that was originally listed at $1,153,500 had to reduce the asking price, often more than once, to $1 million to find success.

Carefully and methodically pricing a home is vital to cashing in on today’s much slower housing market. The first few weeks after coming on the market is absolutely the most crucial time period with the greatest exposure and heightened buyer activity. This occurs because there are many buyers who have not yet secured a home and are eagerly waiting on the sidelines for something to come on the market that meets their criteria. Every time a home enters the fray, there is a rush of initial activity as potential buyers clamor to be one of the first to see it. There is more activity in the initial two weeks than at any other time during the marketing process.

When sellers overprice their homes and do not properly take advantage of the first few weeks after coming on the market, eventually they must improve the price through a reduction. Reducing the price to be more in line with a home’s Fair Market Value is not met with nearly the same fanfare as a home new to the market. The excitement is no longer there. A home becomes a bit “shopworn” and loses some of its marketing allure the longer it sells without success.

A WARNING to Sellers: Overpricing a home risks wasting valuable market time, obtaining a smaller net proceeds check at the close of escrow, and could result in chasing a declining market. Pull the emotion out of the process in arriving at the asking price. Instead, carefully, and methodically isolate the Fair Market Value and achieve the best outcome with the most amount of money.

Recent Posts

GET MORE INFORMATION