Use Your Tax Refund to Make Your Homeownership Dreams a Reality

If you've been dreaming of owning a home, you know that achieving this goal can be financially challenging. From saving for a down payment to covering closing costs, there are many expenses associated with purchasing a property. However, if you're expecting a tax refund this year, you could be in luck. Your tax refund can provide a much-needed boost to help you achieve your home-buying goals.

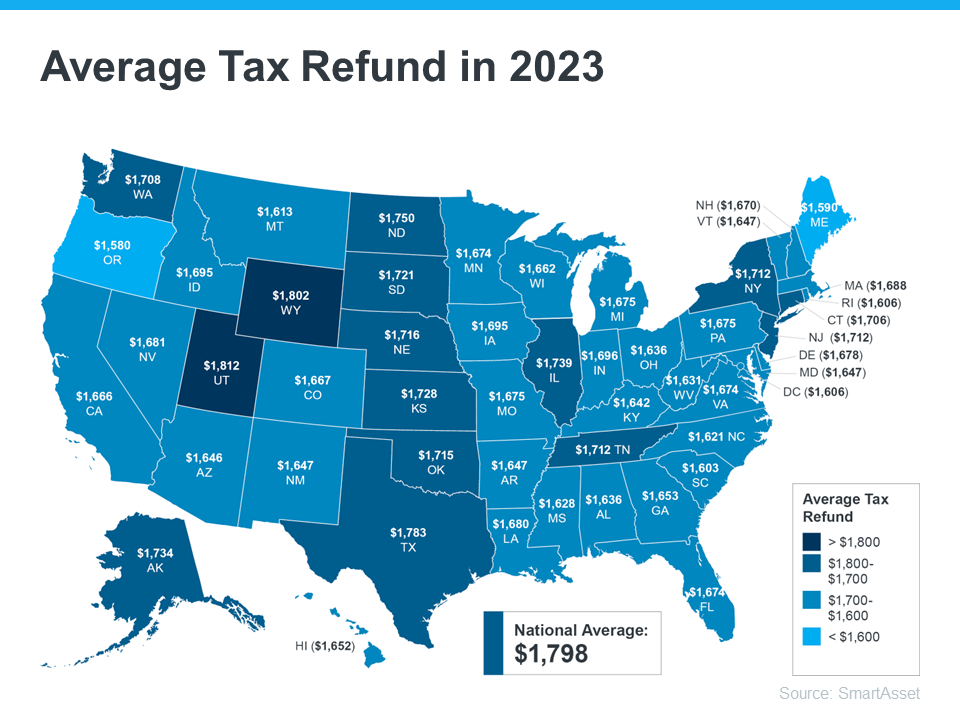

According to SmartAsset, the average American is expected to receive a tax refund of $1,798 this year. The map below provides a more detailed estimate by state:

Freddie Mac suggests several ways to use your tax refund to make homeownership more attainable. In this blog post, we'll explore three key tips for using your tax refund to help you buy a home.

1. Saving for a Down Payment

One of the most significant barriers to homeownership is the need to save for a down payment. Typically, homebuyers are required to put down at least 3.5% to 20% of the home's purchase price, depending on the type of mortgage they choose. If you haven't reached your savings goal yet, your tax refund can provide a substantial contribution to your down payment fund. By allocating your refund towards your down payment, you may be able to achieve your homeownership goals sooner than anticipated.

2. Covering Closing Costs

Closing costs are the fees and expenses you'll need to pay before you can officially take ownership of your new home. These costs typically include charges from your lender, real estate agent, and other parties involved in the transaction. Closing costs can add up quickly, but you can use your tax refund to offset these expenses. By directing your refund toward closing costs, you'll reduce the amount of money you'll need to save or borrow to complete your home purchase.

3. Reducing Your Mortgage Interest Rate

Another way to use your tax refund when buying a home is to lower your mortgage interest rate. Some lenders offer the option to "buy down" your interest rate by paying points upfront. This means you can pay a one-time fee in exchange for a lower interest rate on your fixed-rate mortgage. A lower interest rate can save you thousands of dollars over the life of your loan, so using your tax refund to buy down your rate could be a smart investment in the long run.

Conclusion

Preparing to buy a home can be overwhelming, but leveraging your tax refund can make the process more manageable. By working with a trusted real estate professional who understands the ins and outs of the home-buying process, you'll be better equipped to navigate the various costs and decisions you'll encounter along the way. Remember to consider using your tax refund to help with your down payment, cover closing costs, or lower your mortgage interest rate, and you'll be one step closer to achieving your dream of homeownership.

Recent Posts

GET MORE INFORMATION